Will Fresh Leadership in Sales and Marketing Shift HealthEquity’s (HQY) Long-Term Growth Narrative?

- Earlier this week, HealthEquity announced the appointments of Mukund Ramachandran as Chief Marketing Officer and Garett Kitch as Senior Vice President of Client Sales & Relationship Management, both effective September 29, 2025, to advance its strategic vision and market position.

- The newly appointed executives bring decades of experience in fintech, insurtech, and technology-enabled sales, signaling HealthEquity’s focus on accelerating technology adoption and expanding its reach with both enterprise and consumer clients.

- We’ll explore how the infusion of new executive talent in marketing and sales could reshape HealthEquity’s long-term growth outlook and investment story.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

HealthEquity Investment Narrative Recap

To be a HealthEquity shareholder, you need to believe in the continued expansion of the HSA market and the company’s ability to capture more accounts through technology and differentiated sales execution. The recent executive appointments bring seasoned leadership in marketing and sales, but do not immediately alter the most important short-term catalyst, capitalizing on regulatory-driven market growth. The biggest current risk remains a potential decline in interest rates, which could pressure earnings given HealthEquity’s exposure to custodial cash yields; this risk is not materially changed by the new hires.

One recent and relevant announcement is HealthEquity’s Q2 results, which showed year-over-year gains in both revenue and net income. Strong earnings and updated guidance support the company’s pursuit of profitable growth while providing a backdrop for the new leaders to drive the next phase of expansion. These results underscore the importance of capturing new account openings as regulatory shifts widen the company’s target market.

Conversely, should interest rates fall sooner than expected, this is a risk investors should be aware of, as it could…

Read the full narrative on HealthEquity (it’s free!)

HealthEquity’s narrative projects $1.6 billion revenue and $325.3 million earnings by 2028. This requires 7.9% yearly revenue growth and a $179.5 million earnings increase from $145.8 million today.

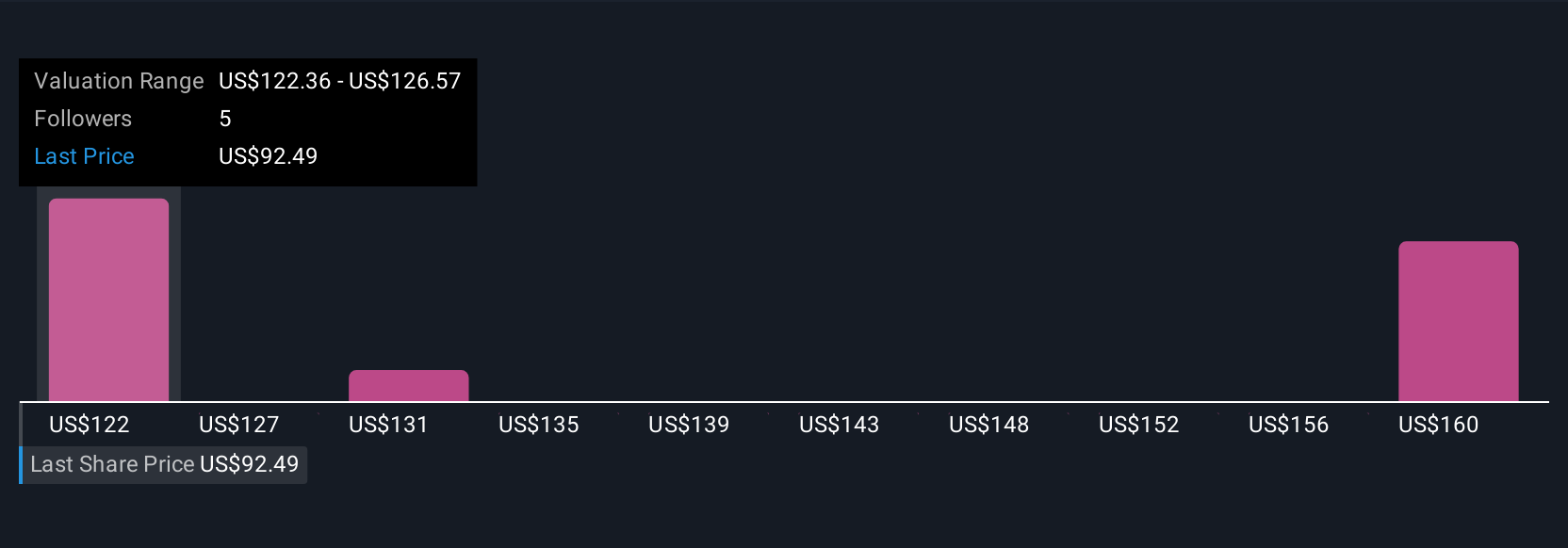

Uncover how HealthEquity’s forecasts yield a $122.36 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for HealthEquity range from US$122 to US$168 across 3 analyses. Yet with the company’s revenue tied to trends in HSA eligibility and ongoing rate sensitivity, your view on these drivers may lead you to a very different conclusion about HQY’s future performance.

Explore 3 other fair value estimates on HealthEquity – why the stock might be worth just $122.36!

Build Your Own HealthEquity Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your HealthEquity research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HealthEquity research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate HealthEquity’s overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link